I have noticed lately that the spinmeisters are now latching on to the term 'currency war,' but are trying to deflect it merely to an intensification of the beggar thy neighbor strategy of devaluing your currency to subsidize exports and penalize imports.

This has been going on for a long time, most notably by the Asian Tigers, led by Japan and then perfected by China. But make no mistake, the real heart of this process is in an Anglo-American banking/industrial cartel that intends to beggar everybody.

The multinational corporations went along with it. They were its great lobbyists, and their wealthy scions the founders of think tanks to provide it a rationale and respectability.

Walmart wrote a chapter in the new gospel of greed as a means of undermining wages and the American working class by insisting, as far back as the 1990's and the Clinton era, that suppliers start offshoring to China. And servile politicians opened the doors wide, and turned a blind eye to abuses that are still coming home to roost.

Part of the arrangement was a quid pro quo. The multinationals, who successfully staged a financial coup d'état in the States and Western Europe, were to extend the reach of their strong dollar policy and europression via foreign direct investments in resources rich overseas nations and foreign markets in order to consolidate their power into the non-democratic world.

But China and Russia balked at their end of the presumed bargain. They realized that opening their own doors to dollar exploitation, and allowing the economic hitmen to come in and pick up assets on the cheap, would lead to eventual political unrest, encirclement, and their own loss of power.

'Color revolutions' were becoming popular, as one country after another was falling into chaos, the kind that produces fire sales in productive assets and the elimination of inconvenient local rivals to power. And in Europe, the powers that be created a Eurozone structure that any decent economist would know was unsustainable, and destined to create an unstable situation of few winners and many big losers.

And so a consortium of nations began to resist. Some called them the BRICS. They became alarmed, and then convinced, that allowing a single nation or group of multinationals to control the world's reserve currency was like a Ponzi scheme that could only continue on until its acquired the whip hand of power everywhere.

They started to speak up in international monetary organizations, long dominated by the Anglo-American banking and industrial cartels. They demanded the establishment of a new monetary standard for international trade that was broadly based, to replace the failed Bretton Woods Agreement that had continuing on as the ad hoc dollar hegemony known as Bretton Woods II after Nixon arbitrarily broke the formal agreement with the closing of the gold window in 1971.

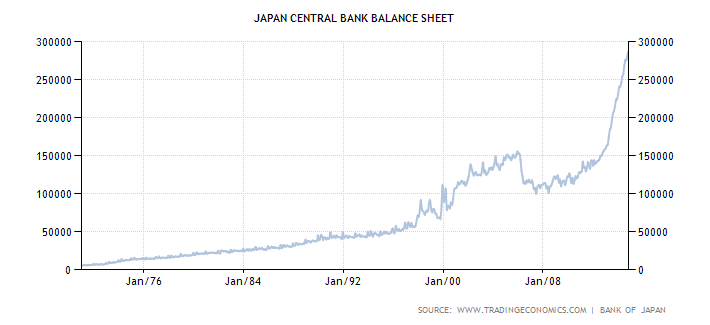

And so we see a new phenomenon today, in which the long term selling of gold to control its price, resulting in the post-Bretton Woods bear market that lasted over twenty years, has given way to net gold buying by the world's central banks, and in increasing size. And the creation of a paper gold market in parallel, through which the West seeks to control the price and supply of gold, to maintain their financial operation while they more aggressively pursue nation recycling and repurposing, draconian trade deals that supplant domestic governance, and when that fails, through internal insurgencies and at times, overt military action.

Simultaneously, there are a proliferation of bilateral trade deals in which currency arrangements are being made between countries, and even among small regional groups of nations, to conduct their business outside of the US Dollar system. They are even building up their own financial networks and infrastructure in response to increasingly aggressive use of sanctions and other forms of economic pressure.

The US and UK, like China and Russia, are not immune to concerns about domestic unrest. A strong dollar policy and the support for a policy of offshoring to increase corporate profits are wreaking havoc on one of the world's greatest popular economic achievements: the US middle class.

Increasingly concerned, the governments are cracking down on any sparks of domestic dissent, targeting leaders, vilifying and suppressing minorities, and increasing the surveillance of its own people. They are weaponizing the domestic police forces, and establishing the 'legal means' by which control can be maintained in the face of increasing misery and discontent at home.

It is not a pretty picture. It is an old story of greed and deceit, of empire and world conquest, of the desolating sacrilege of betraying those who have fought for freedom and civil rights to cash in for their own selfish gains.

Will this end in a new gold standard, as this article A New Gold Standard in the Making, which is the source of these graphs suggests? I surely do not know, and still do not think so.

If you have been following the thought process here, going back before even the establishment of this blog to 2000, I have felt that the most likely course will be the establishment of a new unit of international currency, similar to but not the same as the SDR, with a far broader composition of currencies and commodities included, so that no single group would be able to control it for their own purposes.

Stagflation is no natural phenomenon. It is the act of man in a policy intervention or policy error par excellence. Until OPEC was able to trigger a stagflation through their use of an oil embargo and price cartel in the 1970's in the favorable conditions created by economic rot introduced by years of discretionary, aggressive war in Southeast Asia and the ensuing debts, most economists thought it to be impossible, and certainly not a 'natural' outcome.

I think that domestic reform will be coming, and this is necessary because no new monetary standard is going to repair a system that has failed from within due to corruption and systemic injustice.

Old systems, even when they finally turn to visible abuse as they decline, can fail for a very long time, seemingly unbeatable, until they finally collapse from within. This is how it was for the fall of the old Soviet Union, and this is how it may be for the Anglo-American cartel and their attendant nations like Germany and Japan.

It is still possible that Russia and China could make a deal with the Anglo-Americans and establish a tri-partite world government, with their own spheres of control and interest. As you may recall this was the way George Orwell saw it in 1984. I have been watching for that possible development based on my own research on the growth of international capital markets and flows since 1990 at least.

People bring this up and so I wish to address it now, once and for all. I am aware of the possible deeper significance of these developments from an eschatological perspective. But recall that even the great apostle, who was 'lifted up to the third heaven,' was mistaken in his estimation of it, thinking it a phenomenon of his own time. It is a mistake of vanity to go too far in such arcane and difficult subjects, in pursuit of sick thrills that only serve to distract us from our call to the work of the day, and the practical task of finding sanctity and salvation in the world.

How we will react to this individually is critical for our own long term survival as spiritual beings regardless, since we all face our own ends individually. Of this we can be sure. We are told that most will give in, despairing at the increase in wickedness, and seek for power and riches of their own beyond all reason and grace. And it requires no end time to see this happening through all ages.

Change is coming. It may be a new arrangement that brings with it the blessing of reform, transparency and justice through peaceful evolution. It may be delayed and more difficult. What cannot be sustained will not continue.

This will end. But perhaps not very well. To a great extent that is up to us, unless we stand by and do nothing. "The only thing necessary for the triumph of evil is for good men to do nothing." But what shall I to do? Begin with yourself, despising only the fear and the evil in you. Do as you have been instructed by the two great commandments, which have been implanted as a seed in your heart.

You are called. You choose the answer.